Multimedia content

- Images (4)

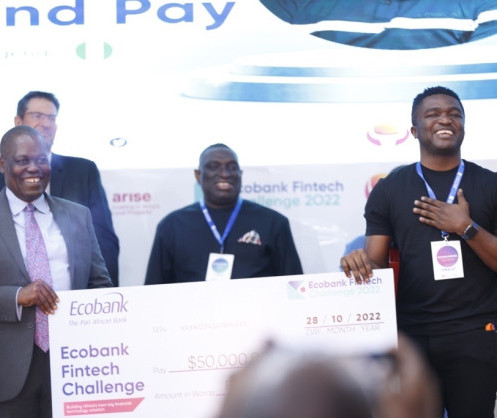

- Ecobank Group CEO Ade Ayeyemi (Left) hands over a cash prize of USD50,000 to Touch and Pay CEO, Michael Oluwole. The Nigerian Fintech emerged top in the challenge

- The 2022 Ecobank Fintech Challenge Finalists together with the judges and staff of Ecobank

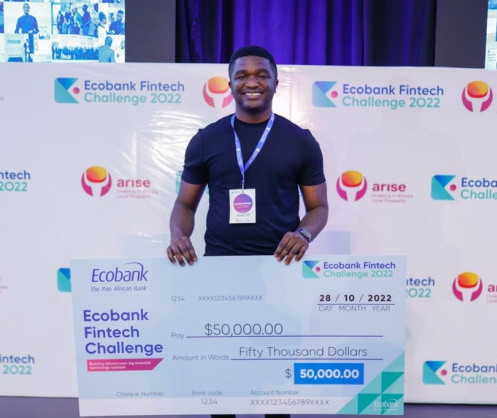

- Michael Oluwole, CEO Touch and Pay is the winner of the 2022 Ecobank Fintech Challenge

- The top six finalists of the 2022 Ecobank Fintech Challenge pose with their Fintech Fellowship accreditation

- All (4)

Touch and Pay wins $50,000 Ecobank Fintech Challenge 2022

Touch and Pay processes microtransactions across Africa, such as paying for bus journeys

This year's six finalists have set the bar high at this Grand Finale

Ecobank Group (www.Ecobank.com) is proud to announce that Touch and Pay a Nigeria-based fintech has won the 2022 edition of the Ecobank Fintech Challenge. This announcement was made at the Grand Finale, today at Ecobank’s headquarters in Lomé, presided by H.E. Cina Lawson, Minister of Digital Economy and Transformation, Republic of Togo. Touch and Pay took home a $50,000 cash prize, the largest no-strings attached fintech cash prize in Africa.

Touch and Pay processes microtransactions across Africa, such as paying for bus journeys. Today, Touch and Pay has over 2 million users who help 500,000 people make payments every day.

The winner and the other five finalists were also inducted into the Ecobank Fintech Fellowship – a unique programme that gives the Fintech Fellows the opportunity to explore potential commercial partnerships with the Bank, such as integrating with Ecobank’s pan-African banking platforms and scaling their fintech businesses across Ecobank’s 33 African markets.

The five other finalists for the 2022 edition are:

- Cauri Money, Senegal

- DizzitUp, Togo

- MaishaPay, Democratic Republic of Congo

- Moni Africa, Nigeria

- Paycode, South Africa

- Touch and Pay, Nigeria

Ade Ayeyemi, Chief Executive Officer, Ecobank Group, congratulating the finalists, said: “This year's six finalists have set the bar high at this Grand Finale. Their innovations are revolutionising the financial payments landscape in Africa and advancing financial inclusion. It is an honour for the Ecobank Group to partner with them and jointly transform the financial landscape of our continent.” Mr Ayeyemi also expressed Ecobank’s “profound appreciation to all our partners especially Arise, the gold sponsor of the 2022 Challenge, as well as to the Jury who worked tirelessly to evaluate the finalists and select the winner.”

Gavin Tipper, the CEO of Arise, a gold partner and co-sponsor of the challenge, said: “Arise extends its congratulations to the finalists and the winner for the creativity and innovation they displayed. The Ecobank Fintech Challenge has become an important platform for supporting fintech innovators and encouraging bold solutions to advancing financial inclusion in Africa. The talent on offer in this year's pool of finalists once again exceeded expectations, and we look forward to seeing how the different products transform financial services on the continent.”

Oluwole Michael, CEO of Touch and Pay expressing deep satisfaction at winning the Fintech Challenge, commented: “We at Touch and pay (TAP) are excited about the opportunity given to us to work with Ecobank, a pan-African bank operating across Africa. This plugs into our vision of helping 250m Africans process cash-based transactions digitally making them truly cashless and providing true credit facilities for merchants, retailers, and customers.”

In addition to the pitch by each of the six finalists and a keynote address by H.E. Cina Lawson, highlights at the Grand Finale included panel discussions on ‘Sustaining and deepening investor interest in African Fintech in the face of global economic crisis: what should investors, Fintech companies and governments do?’ and ‘Ensuring Fintech-friendly regulations that accelerate start-up growth and maturity: what is the best way forward for Africa.’

Almost 4,000 start-ups have participated in the five editions of Ecobank Fintech Challenge since it was launched in 2017. Since then, 52 Fintechs have been inducted into the Ecobank Fintech Fellowship. The 2022 Challenge was supported by partners including Arise, Konfidants, Tech Cabal, Africa Fintech Network and ALX Ventures.

Distributed by APO Group on behalf of Ecobank.

Names, countries and websites of the six Finalists and 2022 Ecobank Fintech Fellows

|

Name |

Country |

Website |

|

DizzitUp |

Togo |

DizzitUp (www.DizzitUp.com) |

|

MaishaPay |

DRC |

|

|

Paycode |

South Africa |

|

|

Moni Africa |

Nigeria |

|

|

Touch and Pay |

Nigeria |

|

|

Cauri Money |

Senegal |

Media Contacts:

Christiane Bossom

Corporate Communication Manager

Ecobank Group

Email: groupcorporatecomms@ecobank.com

Tel: +228 22 21 03 03

Web : www.Ecobank.com

Zeenat Parker,

Head of Communications

Arise

Email: zeenat.parker@ariseinvest.com

Tél : +27 81 248 2801

About Ecobank Transnational Incorporated (‘ETI’ or ‘The Group’):

Ecobank Transnational Incorporated (‘ETI’) is the parent company of the Ecobank Group, the leading independent pan-African banking group. The Ecobank Group employs about 13,000 people and serves over 32 million customers in the consumer, commercial and corporate banking sectors across 33 African countries. The Group has a banking licence in France and representative offices in Addis Ababa, Ethiopia; Johannesburg, South Africa; Beijing, China; London, the UK and Dubai, the United Arab Emirates. The Group offers a full suite of banking products, services and solutions including bank and deposit accounts, loans, cash management, advisory, trade, securities, wealth and asset management. ETI is listed on the Nigerian Exchange in Lagos, the Ghana Stock Exchange in Accra, and the Bourse Régionale des Valeurs Mobilières in Abidjan. For further information please visit www.Ecobank.com

About Arise:

Arise is a leading African investment company that partners with sustainable, locally owned financial and non-banking institutions in Sub -Saharan Africa. The company was founded by several cornerstone investors namely Rabobank Partnerships, Norfund, NorFinance and FMO and currently, manages assets in excess of USD 1 billion. (www.AriseInvest.com).