Multimedia content

- Images (3)

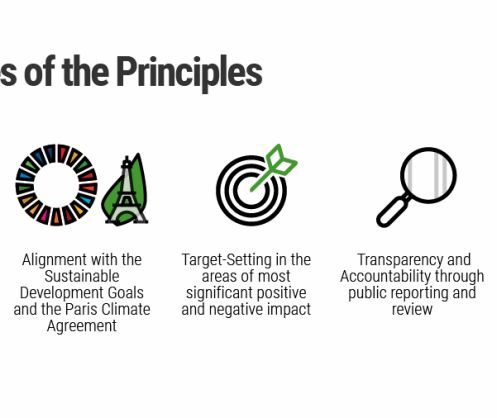

- 6 Principles

- Ecobank signs up to The United Nations Environment Programme’s Finance Initiative (UNEP FI) Principles for Responsible Banking

- Key features

- Links (1)

- All (4)

Ecobank signs up to The United Nations Environment Programme’s Finance Initiative (UNEP FI) Principles for Responsible Banking

The Principles aim to create a financial sector that serves people and the planet while delivering positive impacts and improving people’s quality of life

By subscribing to the six Principles for Responsible Banking we are publicly declaring that we follow the best-in-class sustainability practices

Ecobank Transnational Incorporated ( ETI) (https://www.Ecobank.com/) is delighted to announce that it has become an official Signatory to the UN Principles for Responsible Banking: a single framework for a sustainable banking industry developed through an innovative partnership between banks worldwide and United Nations Environment Programme’s Finance Initiative.

The six Principles for Responsible Banking1 align the banking sector with the objectives of the UN Sustainable Development Goals and the 2015 Paris Climate Agreement. They embed sustainability across all business areas and enable banks to identify where they can make the most impact to the sustainable development of economies and the world. The Principles aim to create a financial sector that serves people and the planet while delivering positive impacts and improving people’s quality of life, without compromising that of future generations.

Ade Ayeyemi, Group CEO of Ecobank said : “At Ecobank we take our sustainability responsibilities seriously by continuously ensuring that sustainable practices are established throughout our decision making, management, business activities and organisation. Along with our customer-centric focus and intent to be a trusted adviser, we take a proactive leadership role in sustainability and our decisions and actions always take account of society’s goals and Africa’s future generations. By subscribing to the six Principles for Responsible Banking we are publicly declaring that we follow the best-in-class sustainability practices that have been adopted by major global banks.”

Members of the banking industry of UNEP FI have developed the six Principles of Responsible Banking to refine the business and Environmental, Social and Governance practices in the banking industry. The Principles guide banks in their sustainability stewardship and challenge them to continuously increase their contribution towards a sustainable future.

Ecobank has been a signatory to the UNEP FI since 2009. The Initiative has 274 financial institution members from the Banking, Insurance and Investment industries. Ecobank also serves on the Global Steering Committee (GSC) of UNEP FI.

1The six Principles for Responsible Banking are:

- Alignment: We will align our business strategy to be consistent with and contribute to individuals’ needs and society’s goals, as expressed in the Sustainable Development Goals, the Paris Climate Agreement and relevant national and regional frameworks.

- Impact & Target Setting: We will continuously increase our positive impacts while reducing the negative impacts on, and managing the risks to, people and environment resulting from our activities, products and services. To this end, we will set and publish targets where we can have the most significant impacts.

- Clients & Customers: We will work responsibly with our clients and our customers to encourage sustainable practices and enable economic activities that create shared prosperity for current and future generations.

- Stakeholders: We will proactively and responsibly consult, engage and partner with relevant stakeholders to achieve society’s goals.

- Governance & Culture: We will implement our commitment to these Principles through effective governance and a culture of responsible banking.

- Transparency & Accountability: We will periodically review our individual and collective implementation of these Principles and be transparent about and accountable for our positive and negative impacts and our contribution to society’s goals.

Ecobank has integrated the UNEP FI framework with its internal Environment and Social Management Systems (ESMS), which was developed on the basis of our engagement with the globally recognised ESG frameworks, such as IFC Performance Standards as well as our association with other financial institutions on their interpretation of environmental and social management as related to the credit review process. Furthermore, as a result of our membership, we are gaining a better understanding in ensuring that projects financed and eligible transactions in the E&S sensitive sectors are developed in a socially responsible manner and reflect sound environmental management practices. The Bank continues to ensure that negative socio-environmental impacts are avoided and where possible the Bank engages the project proponents in establishing a set of corrective mitigating measures.

Distributed by APO Group on behalf of Ecobank.

Media Contact:

Christiane Bossom

Group Communications Manager

Email: cbossom@ecobank.com

Tel: +228 22 21 03 03

About Ecobank Transnational Incorporated (‘ETI’):

Ecobank Transnational Incorporated (‘ETI’) (https://www.Ecobank.com/) is the parent company of the Ecobank Group, the leading independent pan-African banking group. The Ecobank Group employs over 15,000 people and serves about 20 million customers in the consumer, commercial and corporate banking sectors across 33 African countries. The Group has a banking licence in France and representative offices in Addis Ababa, Ethiopia; Johannesburg, South Africa; Beijing, China; London, the UK and Dubaï, the United Arab Emirates. The Group offers a full suite of banking products, services and solutions including bank and deposit accounts, loans, cash management, advisory, trade, securities, wealth and asset management. ETI is listed on the Nigerian Stock Exchanges in Lagos, the Ghana Stock Exchange in Accra, and the Bourse Régionale des Valeurs Mobilières in Abidjan .

For further information please visit www.Ecobank.com